No Firm is an Island

It’s long overdue that asset managers recognize their investments are embedded in a wider system rather than merely investing in companies and portfolios in isolation. The UN Sustainable Development Goals (SDGs) are a useful starting framework for asset owners to achieve a systems-robust portfolio, says Michael van der Meer in his award-winning paper.

In early finance (think the Ben Graham-era before the late 1940s) individual investments were analyzed on their own merit and therefore assumed to be stand-alone and uncorrelated. Modern Portfolio Theory (MPT) was the seminal breakthrough in the 1950s that asset classes correlate differently and inter-dependences matter. Unfortunately, 70 years on most asset owners have barely moved beyond basic MPT. In our view asset managers can no longer ignore the deeper, systemic, inter-dependencies within their portfolios and must take steps to integrate considerations of these into their analysis.

We know that companies do not exist in seclusion; and companies, to varying degrees, play lip-service to this in their corporate responsibility reports. This is progress from the early firm-centric view, which merely assigns the profit motive. But assigning such inchoate goals to these “legal persons” is akin to releasing a sociopath into society with an underdeveloped sense of morality and then being surprised by the undesirable consequences! There are good reasons why completely selfish agents in simulations make systems fail, while social agents are able to solve complex coordination problems.[1] The same is true for individuals, companies, societies and any other institutions.

Asset managers and other company owners have a longer-term interest to overcome collective coordination problems such as climate change and excessive inequality. Not only should meaningful corporate citizenship be embraced at the firm-level, but asset owners should also consider how sustainable their portfolios really are. After all there is no point in investing in a portfolio which, for example, depletes water resources which will be needed by you, your children’s, or your grandchildren’s portfolio in 10, 20, or 30 years. Ultimately, we all have a stake in fixing this coordination problem. Typically, these can only be solved by larger actors who have the resources to coordinate action, though preferably not governments. This is an opportunity for asset owners.

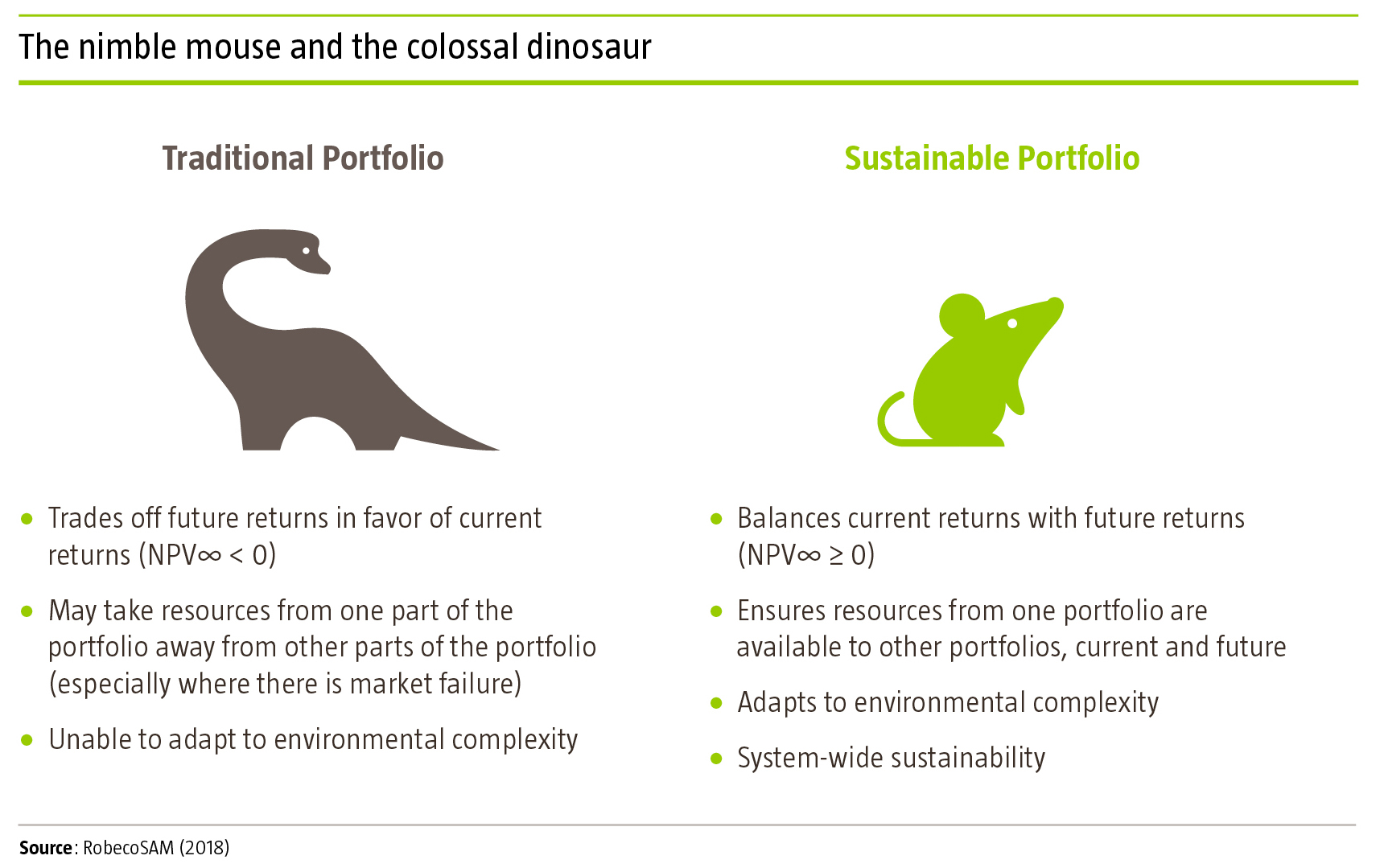

But where to start? There remains a preference at most asset owners to favor short-term returns in exchange for long-term liabilities, in large part because individual asset managers are incentivized this way. This means that most investment portfolios still, on aggregate, borrow from the future to outperform in the present. But if we start adopting transparent ways to measure managers’ performance against broader goals, we can start to shift these incentives. Unfortunately, we are only in the early stages of this shift towards a more sustainable approach.

We argue that the UN SDGs are a good starting framework to help evaluate whether companies’ products and services are consistent with resolving the systemic challenges that exist today, thereby creating true long-term value. While the SDGs are complex, and at time contradictory, they allow for trial-and-error approach by private entities suited to local circumstances. This is, again, an opportunity for asset managers: to choose those companies that are aligned with the SDGs, but also to measure themselves and align incentives with, the SDGs.

In summary, disassociating economic activity from other societal objectives is counter-productive. We believe it is possible to resolve many of these issues by adopting a systems thinking approach which moves beyond traditional portfolio management. Sustainable portfolio construction, to safeguard portfolio returns by better aligning the short-term assets and avoiding long-term liabilities creates an opportunity for asset managers to get ahead of the game in offering clients the added-value of a sustainably-managed portfolio.

The full paper, named Best Thought Leadership Paper on Sustainable Investing at the 2019 Investment Week ESG Awards, can be accessed by clicking on the attached link.